Get Started With

servzone

Overview

A non-governmental organization (NGO) is a legally established organization created by natural persons who work independently without government intervention. This term “NGO” is usually used by the government to refer entities that have no government status. NGOs are primarily engaged in social, cultural, legal, & environmental activities without any profit motive.

Why is NGO registration?

NGO Registration enables you to be clear in the eyes of law if you want to set up a non-profit organization and work for the betterment or improvement in any specific area of society.

Legal Potential Methods

- Trust Registration under “The Indian Trust Act, 1882”

- Society Registration under “Societies Registration Act, 1860”

- Section 8 Company Registration under “The Companies Act, 2013”

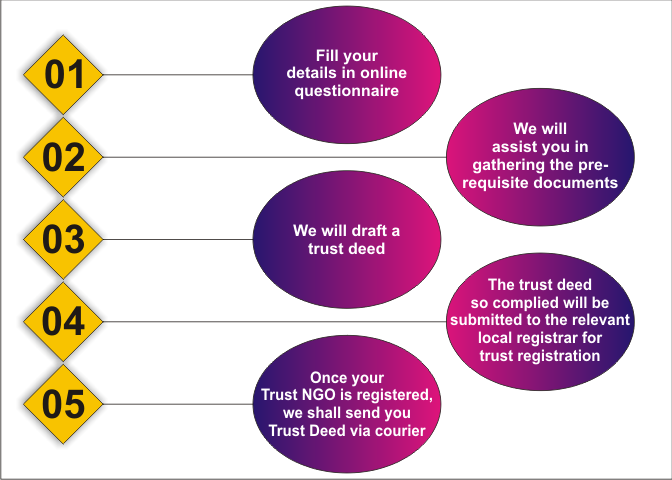

Procedure for NGO Registration - Trust Registration

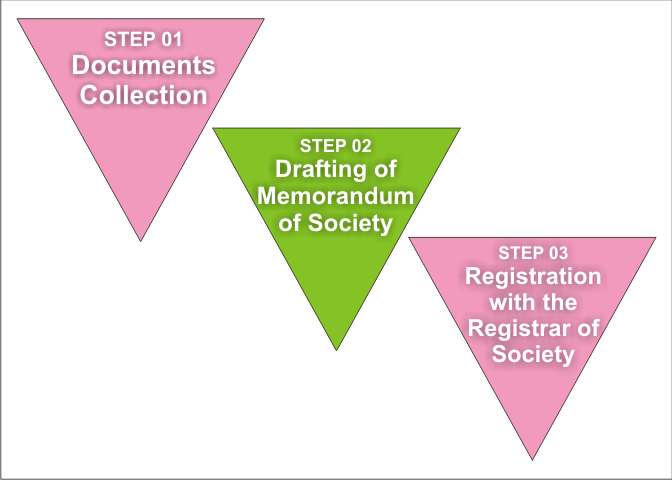

Procedure for NGO Registration - Society Registration

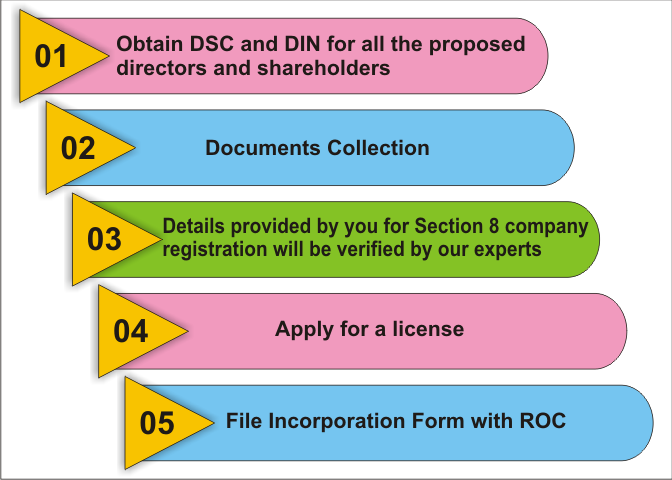

Procedure for NGO Registration - Section 8 Company Registration

Required Docoments for Section 8 company

- At least two shareholders;

- At least two directors (directors and shareholders may be the same person);

- At least one director will be domiciled in India;

- No minimum capital is required;

- In the case of Indian citizens, 'Income tax PAN' is a requirement.

- Copy of identity proof (Voter ID / Aadhaar Card / Driving License / Passport) Passport is a mandatory requirement for identification in case of international residents;

- Proof of residence;

- Registered office proof (no objection certificate from the owner of the premises);

- Memorandum & Articles of Association of the Company;

- A declaration approving the application by a Company Secretary in Practice on the Non – Judicial stamp document of prescribed value;

- List of 'names', 'descriptions', 'addresses' & 'occupation' of the promoters as well as of the Board Members;

- A description of the assets and liabilities of the company by date of use;

- Estimates of future annual income;

- a statement providing a brief description of the work;

- A statement giving a brief description of what has been requested in some places;

- A declaration in prescribed form on non – judicial stamp paper by each person making an application;

- A letter of authorisation;

- Payment of fee.

80G certificate

The 80G certificate is awarded to a non-profit organization or non-governmental organizations (NGO) by the 'Income Tax Department'. The purpose behind the 80G certificate is to encourage donors to donate more charitable funds to such organizations. The main advantage is that by donating to NGOs, the donor gets a 50% tax exemption on their donation. Donors are allowed to deduct their donations from their gross gross income.

12A registration

Significantly, through 12A registration, NGOs get tax exemption. Non-governmental organizations are primarily created to serve a charitable purpose. However, they have revenue and if not registered under Section 12A of the Income Tax Act will have to pay a fee as per standard rates.

Income tax on charitable institutions / non-governmental organizations

The trust is required to use at least 85% of its revenue for charitable or religious subjects in India. Further, the income employed for the purchase of 'capital assets', 'repayment of loan for the purchase of capital assets', 'revenue expenditure' and contributions to trusts registered under section 12AA and section 10 (23C) shall also be deemed to be applicable. . Charitable purpose and therefore exempt from tax.

Religious views are necessarily linked to religion and matters of faith with individuals or organizations. This includes propagating, endorsing or promoting religion and its beliefs. Immunity under section 11 is only accessible to public religious trusts and not to rely on for personal spiritual purposes.

Training memorandum, impact of GST on resorts, and work entrusted by a charitable trust

If a charitable trust is participating in training programs, yoga camps or other programs that are not free to members / participants, it will be considered a commercial activity and hence it will be liable to GST. Even the contribution received for such an event will be responsible for taxation under GST.

- Services offered through training or coaching in productive activities related to 'arts and culture', or sports by a charitable institution will be excluded / exempted from the GST.

- If the Trust is running under the Charitable Discovery of the GST, such activities will be accepted as charitable activities, and the proceeds from such supplies will be exempted completely from the GST.

Difference Between - Trust, Society & Section 8 Company

- means

A trust is an agreement between the parties, under which one party owns the property for the benefit of the other party.

Society is a collection of individuals, who come together for the beginning of any literary, scientific or charitable purpose.

Section 8 is a company formed with a social or charitable object that intends to apply its profits to promote such purpose.

- NGO Registration

As an NGO / NPO, only Section 8 enjoys the privileges of a limited company without using words “Limited” or “Private Limited” in its name.

- Governing Law

In the case of trusts, the Indian Trust Act, 1882 governs private trusts, while the common law governs public trusts except in states such as Gujarat, Maharashtra, where they have separate public trust acts.

In the case of societies, the Societies Registration Act, 1860 regulates societies.

In the case of a Section 8 company, the Companies Act, 2013 Section 8 regulates companies.

- Registration Authority

In case of trust, the sub registrar of the concerned area is a registration authority.

In the case of a society, the registrar or deputy registrar of the society of the state is a registration authority.

In the case of a Section 8 company, the Registrar of Companies (ROC) or Regional Director is a registration authority.

- Minimum Members

In case of trust, a minimum of 2 trustees are required to form a trust.

In the case of a society, a minimum of 7 members are required to form a society.

In case of Section 8 company, minimum 2 directors and minimum 2 shareholders are required. The same person can be appointed as a director and shareholder in a company.

- Geographical area of ??operation

In case of trust, entire India

In the case of society, state-wise, but after the formation of the National Level Society can work across India.

In case of Section 8 company, entire India.

- Supporting Formation Document

In case of Trust, Trust Deed

In case of Society, Memorandum of Association and Rules & Regulations

In case of Section 8 Company, Memorandum of Association and Articles of Association.

- Property Title Legal

In the case of a trust, the title of the property is in the hands of the trustees.

In the case of the Society, the title of the property held in the name of the Society.

In the case of a Section 8 company, the title of the property held in the name of the company.

- Cost Factor

In terms of trust, the cost is low.

In the case of society, th

In the context of government grants, there is a preference

In terms of trust, not more preferred.

In the case of society, not much is preferred.

In case of Section 8 company, highly preferred.

e cost is moderate.

In case of Section 8 the cost of the company is slightly higher.

- Tax exemption under the Income Tax Act, 1961

In case of trust, yes, permission is granted.

In case of Society, yes, permission is granted.

In the case of a Section 8 company, yes, permission is granted.

- In case of Foreign Contribution Regulation Act (FCRA) registration .

In terms of trust, not more preferred.

In the case of society, not much is preferred.

In case of Section 8 company, which is mostly preferred.

- Transparency in working

In terms of trust, not much.

In the case of society, not much.

Due to offline availability in the case of Section 8 company, higher.

- Annual Compliance Requirement

In the case of a trust, some annual compliance is required, such as a private trust or public trust, depending on the type of trust.

In the case of the Society, annual filing of the list of names, addresses and occupations of the members of the Society's Managing Committee with the Registrar of the Society is mandatory.

In the case of a Section 8 company, annual compliance with registration of accounts and filing of annual returns with the Registrar of Companies (ROC) is mandatory.

Create a Section 8 company:

- If you want to do extensive activities.

- If you want a recognized legal structure of a company without any minimum capital requirement.

- If you want credibility and credibility for your organization, as the central government has given the license.

NGO registration Provess

A Trust:

- If more than one family member is involved in running the business.

- If you want better privacy in business and flexibility in sharing among members.

- If you want the trustees to hold office for a lifetime without an election.

A Society:

- If you want an elected body to manage the affairs of the business.

- An option is required for members to leave if they wish.

- If members want to make business easier.

Benefits

As a Section 8 company by NGO registration, it attains a special status. This is exempt from tax, as subscribers and donors can claim an exemption for contributions made. Apart from the tax exemption, the company is also exempted from the applicability of various compliance.

Being registered as a company, it attains an independent status apart from its members. It can hold and hold property / assets and liabilities in its name irrespective of the relationship with members or contributors.

A company registered under section 8 guarantees limited liability to its members. Members' responsibilities are limited only to the capital contributed.

Although the company experiences the benefit of the corporate entity, it is not labelled as the corporate entity. The company cannot add the suffix “Private Limited” or “Limited” after its title. This is implemented so that third parties offer their attention to the company’s purpose and not to its status assuming it is a profit-making organisation.

- Tax exemption

- Distinct Identity

- Restricted Liability

- No Corporate Name

GST Registration

PVT. LTD. Company

Loan

Insurance